Hello traders, I hope you’re doing well. In this blog, we’ll cover the key recent developments shaping both crypto and traditional markets, from Federal Reserve shifts to major DeFi breakthroughs and accelerating global adoption.

The week opened with long-awaited US inflation data, and it came in slightly better than expected. The Consumer Price Index (CPI) dropped to 3.0% year-on-year, below forecasts of 3.1%, while monthly CPI rose 0.3%, also a bit cooler than expected. Core inflation followed the same pattern.

This minor drop was enough to fuel hopes that the Federal Reserve may finally end its policy of Quantitative Tightening (QT). Analysts at JPMorgan predicted that the Fed could announce the end of QT as soon as next week, a move that would inject liquidity back into the markets and lift risk assets such as stocks and Bitcoin.

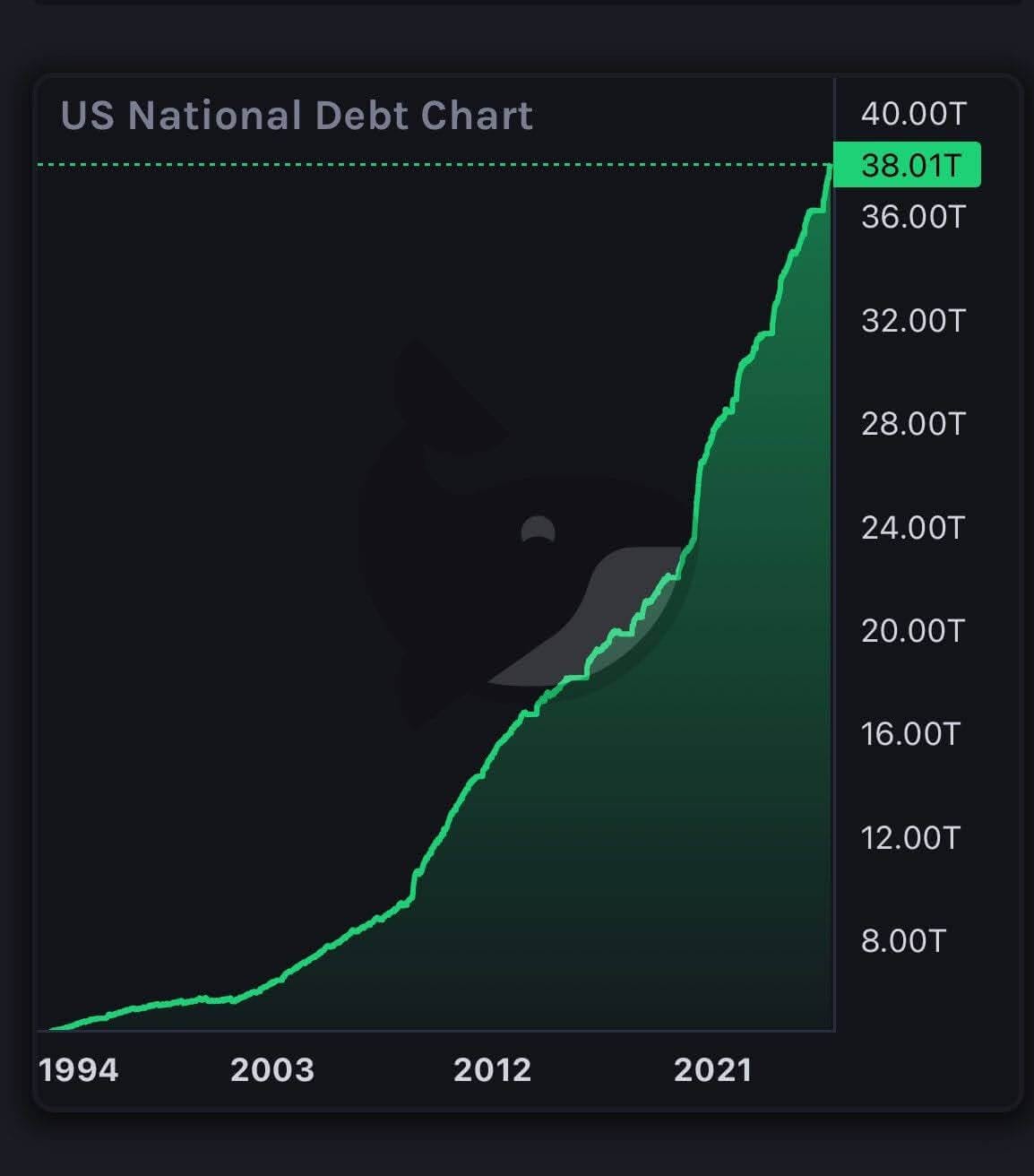

At the same time, the US national debt crossed $38 trillion, adding $500 billion in just one month. It was a reminder that while liquidity might return, fiscal discipline certainly hasn’t.

Perhaps the biggest story of the week came from JPMorgan itself, which announced plans to allow Bitcoin (BTC) and

[...]

Creating freedom through Crypto as a Community

One Response

Thank you. I find all of your articles fascinating. Full of new information for my already overworked brain. I very much appreciate the effort you put in and the chance it provides, for me to learn new and useful information.