The onchain derivatives narrative is no longer easy to dismiss.

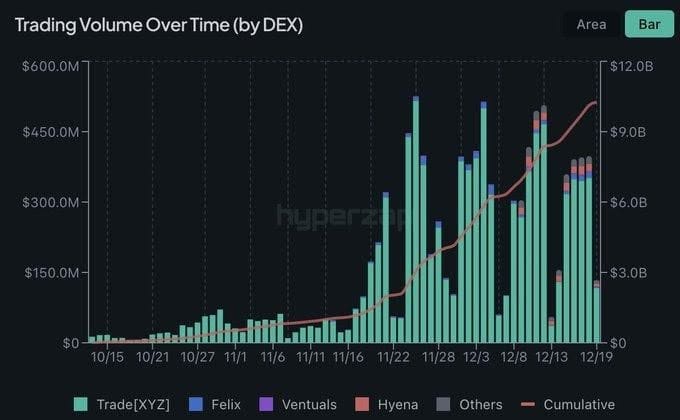

On Hyperliquid, reported trading volume doubled from roughly $5B to $10B in about three weeks. Moves like that usually don’t come purely from excitement. They tend to show that traders are beginning to treat the platform as actual infrastructure, not just another short-term experiment.

A major driver is HIP-3, which allows onchain perpetual trading for real-world assets such as equities, available 24/7. If this model keeps expanding, the distinction between “crypto trading” and “traditional markets” starts to blur.

Instead of two separate systems—crypto exchanges on one side and stock brokers on the other—you begin to see a single, always-on market layer where:

trade together with crypto-level speed and settlement.

The deeper message is subtle but important: the core mechanics of legacy markets are gradually shifting onchain, whether regulators and incumbents openly acknowledge it or not.

Attention has also turned to BitMine and its reported plan to accumulate a significant portion of ETH supply. Estimates suggest it has already completed around 66%

[...]