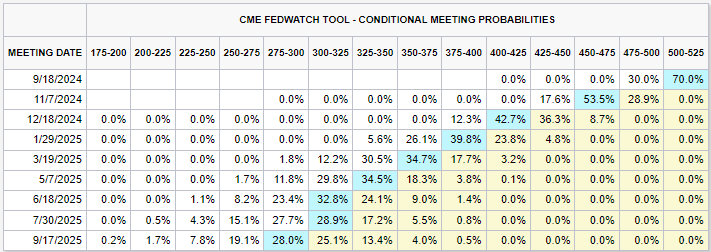

As we approach September 18th, all eyes are on the Federal Reserve and its next move regarding interest rates. The market remains uncertain about whether the Fed will implement a 25 or 50 basis point (bps) rate cut, with current pricing indicating a mix of both possibilities. As investors and traders await clarity, understanding the rationale behind these potential cuts and their broader implications is crucial for navigating the current economic landscape.

As of: 09/07/24

The Uncertainty Around the September Rate Decision

At the time of publishing, the rates market is pricing 32.5 bps for the next cut, which reflects uncertainty about whether the Federal Open Market Committee (FOMC) will opt for a 25 or 50 bps reduction. This ambiguity suggests the market is on the fence, with no clear indication of which direction the Fed will take. On one hand, a 25 bps cut seems more plausible given that there is no immediate economic emergency or significant inflationary pressure. On the other hand, a 50 bps cut might be necessary to address missed opportunities from earlier in the year and to ensure the Fed stays ahead of potential economic weakness.

Arguments for a 25 Basis Point Cut

Proponents of

[...]

2 Responses

Thanks, Jarrid, for writing your post in easy terms.

Thankyou