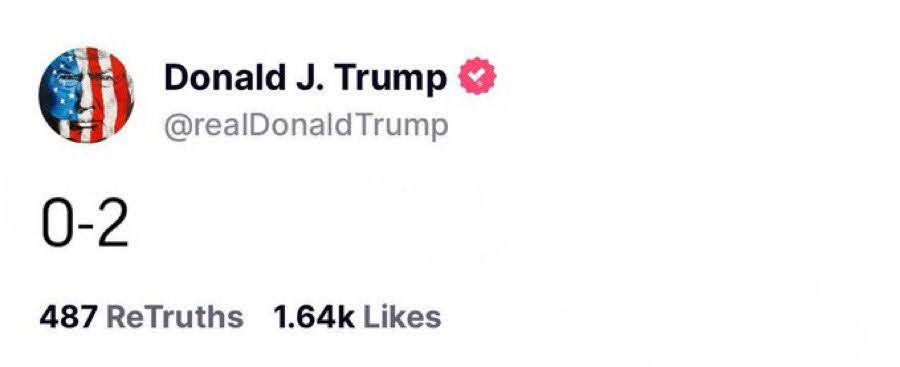

Former President Donald Trump assured his supporters he is “safe and well” after shots rang out while he was golfing at Trump International Golf Club in West Palm Beach in Florida on Sunday afternoon.

“Nothing will slow me down. I will NEVER SURRENDER!” he wrote in an email his campaign sent to donors shortly after the incident.

“I will always love you for supporting me,” he added. “Unity. Peace. Make America Great Again,” he added.

This Black Swan Event certainly had its toll on the market, pushing $BTC back below the critical 60k mark.

Federal Reserve officials are heading into their policy meeting on Tuesday with a lot of optimism, and some uncertainty too.

Inflation is finally cooling off, edging closer to their 2% target. But the big question remains:- How much will they ease up on interest rates?

Recent data suggests price pressures have eased so much since the surge in 2021-2022. 12-month consumer inflation is at its lowest since February 2021. There is also no upstream of costs from Wholesale prices pushing inflation anymore.

With inflation numbers looking friendlier, the path seems clear for an interest rate cut at the

[...]