This Time Could Be Very Different

The crypto market has changed a lot since 2021. Back then, there were around 20,000 altcoins. Today, in 2025, there are tens of millions. Add to that the explosive rise of meme coins tied to high-profile figures—and their subsequent crashes—and it’s clear the market is more chaotic than ever. Here’s how these shifts (and a few notorious rug pulls) could shape the next altseason.

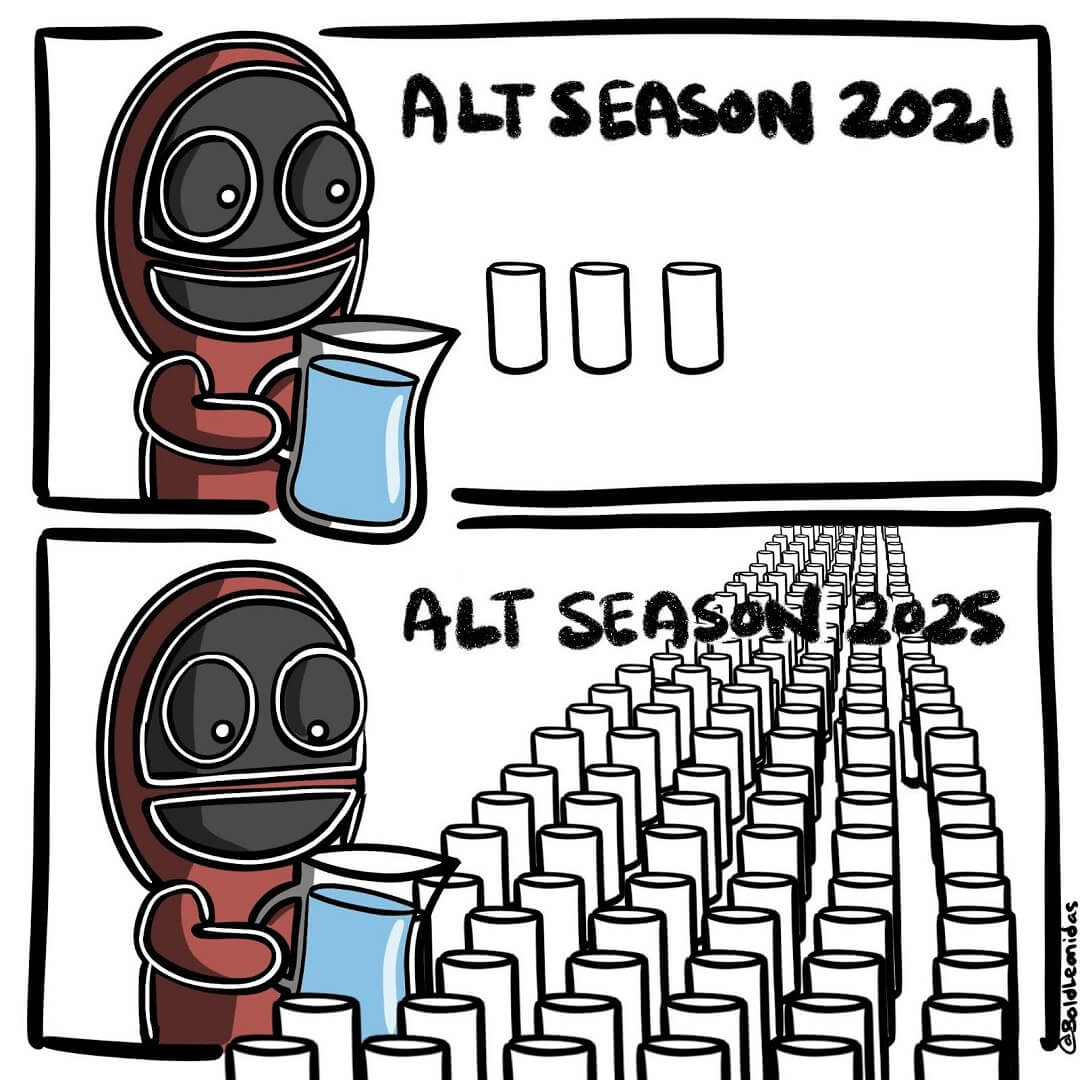

In 2021, investors had fewer altcoins to choose from. Now, with millions of tokens, any incoming funds are spread extremely thin. Imagine pouring a glass of water into a swimming pool vs. a bucket – the water level (token prices) won’t rise as much. This “dilution” means even if a lot of money enters the market, gains for individual altcoins might be smaller than in 2021.

Compounding this problem, the surge in meme coins over the past few months has further skewed market sentiment. Many of these coins rode hype waves thanks to celebrity or political endorsements, only to crash dramatically—intensifying investor caution.

Crypto rallies often depend on easy money policies (like central banks printing cash). In 2017 and 2021, global

[...]

One Response

With a weak prospect for new liquidity / QE in the next 18 months, USD weakness is another possible reason for BTC to rally over the coming couple of months.