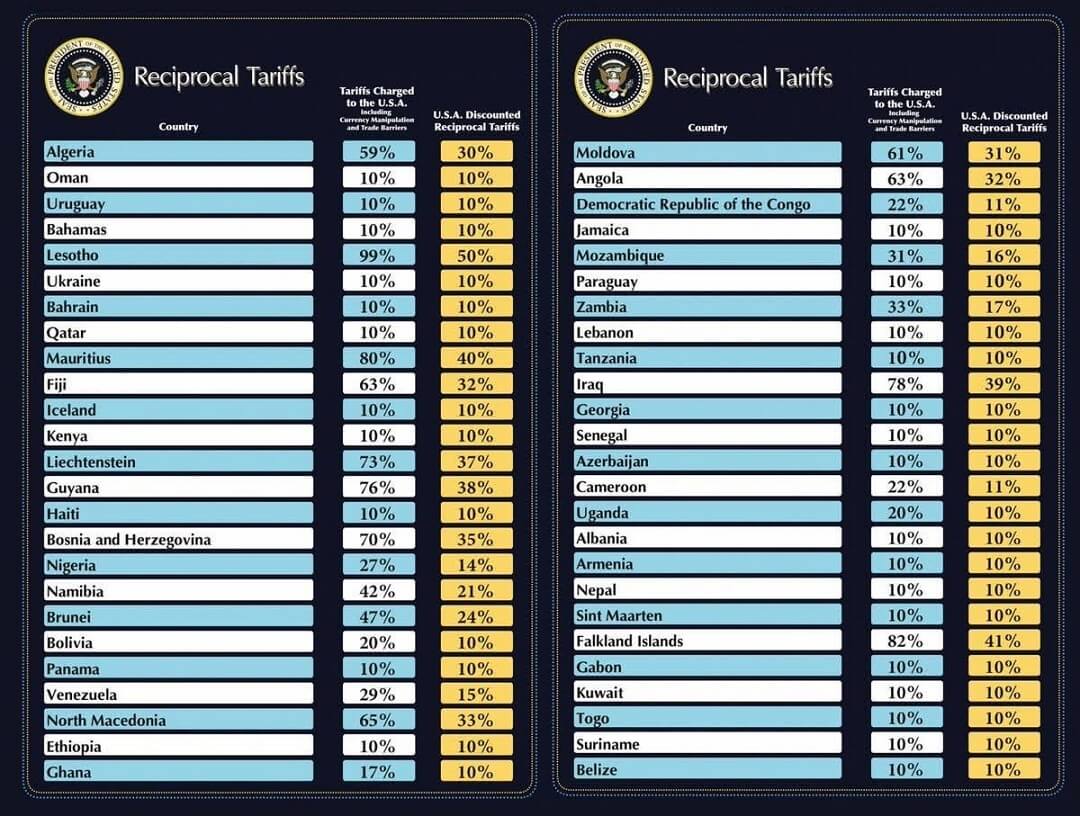

This past week marked one of the most volatile periods for global markets since the COVID-19 crash of March 2020. It started with President Trump announcing historic reciprocal tariffs on over 25 countries. The US effective tariff rate is now above 25%, higher than even during the 1930s Smoot-Hawley Tariff Act. Such a sudden hike in tariffs last occurred before the Great Depression, when US markets collapsed by 86%.

Source | White House

Markets didn’t wait to react. The Nasdaq 100 officially entered a bear market after dropping 6% in a single day. US stocks have lost over $11 trillion since February 19, with recession odds now above 60%. The S&P 500 also fell more than 10% in just two days, a rare event seen only six times before, most recently in 2020.

Source | Tradingview

This wasn’t just a US story. The Nikkei 225, Russell 2000, and even tech giants like the Magnificent 7 stocks joined the downward spiral. The economic uncertainty index in the US reached an all-time high, suggesting more turbulence may follow

US President Trump’s aggressive tariff policy caused a ripple effect. China quickly hit back with 34% tariffs

[...]

Creating freedom through Crypto as a Community

One Response

I love your summaries Wolfy. Thank you!