It has been a difficult week for Bitcoin. The market saw a sharp and steady drop that pushed sentiment into what traders call “Extreme Fear” on the Crypto Fear & Greed Index. For many experienced participants, this feeling wasn’t new, and interestingly, it’s not always a bad sign.

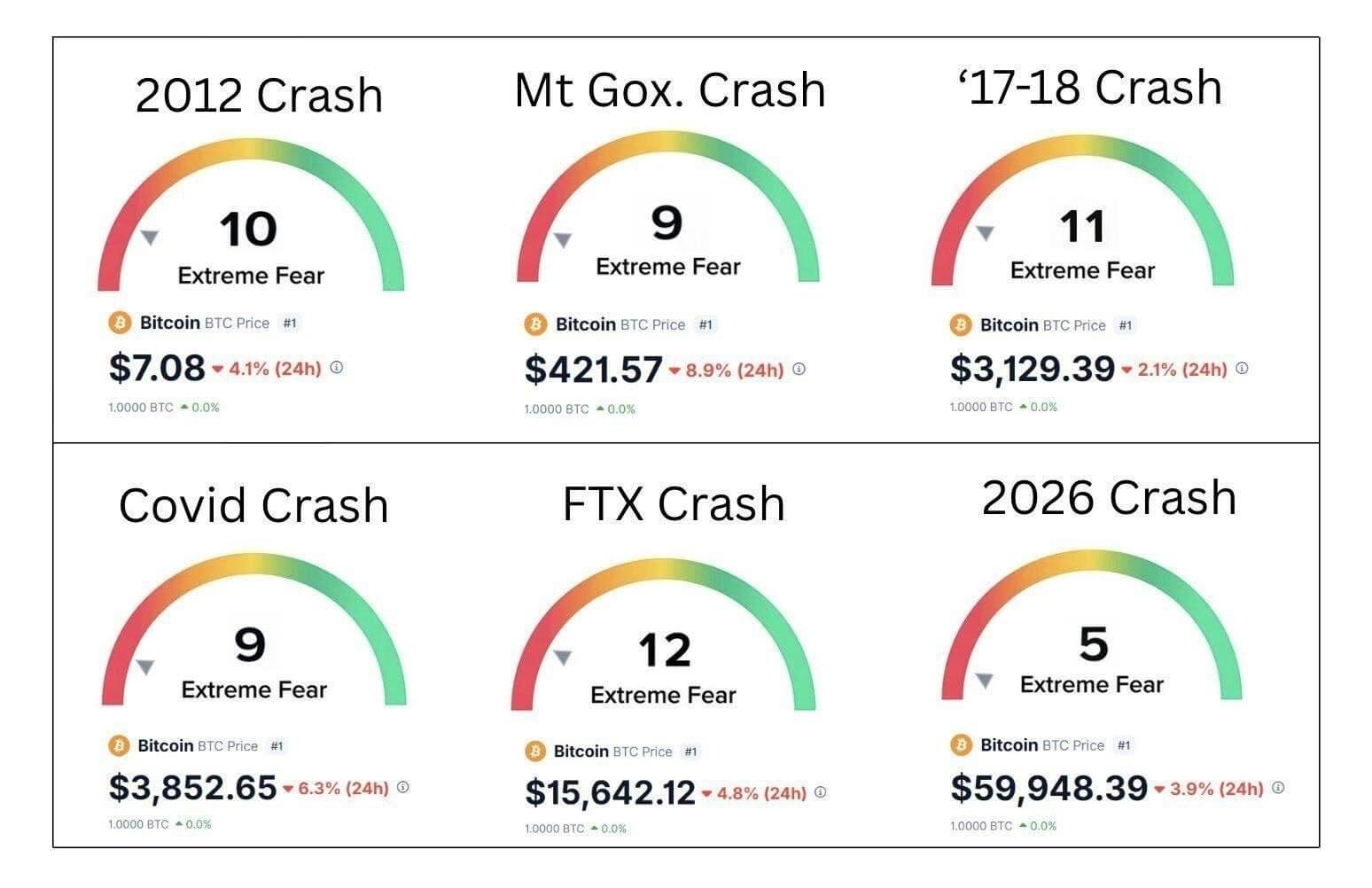

Analyst Quinten François highlighted that in Bitcoin’s history, periods of extreme fear have often marked major turning points rather than the end of the cycle. He compared the current situation to past events like the 2012 crash, the Mt. Gox collapse, the 2018 bear market, the COVID crash in 2020, and the FTX collapse in 2022. In each of those phases, Bitcoin traded at prices that seemed extremely low at the time, yet long-term holders who stayed patient were eventually rewarded.

What makes this cycle different, he argues, is the stronger foundation in 2026. Institutional investors are active, ETFs exist, some governments are even mining Bitcoin, and the overall infrastructure around the network is far more mature than in earlier crashes. From this perspective, fear may simply indicate weak hands exiting the market, not the end of Bitcoin’s long-term story.

This view is supported by on-chain data from CryptoQuant, which identified one

[...]

2 Responses

Thank You!:)

Excellent analysis. Lots to consider. Thank you.