In this week’s blog we’ll cover insights on the current state of market risks from financial analysis firm Variant Perception. Their viewpoint might come as a surprise to many who perceive the current period as fraught with increased risks. The distinction between market risks and global political risks is crucial in this context.

Historical Context and Current Perception

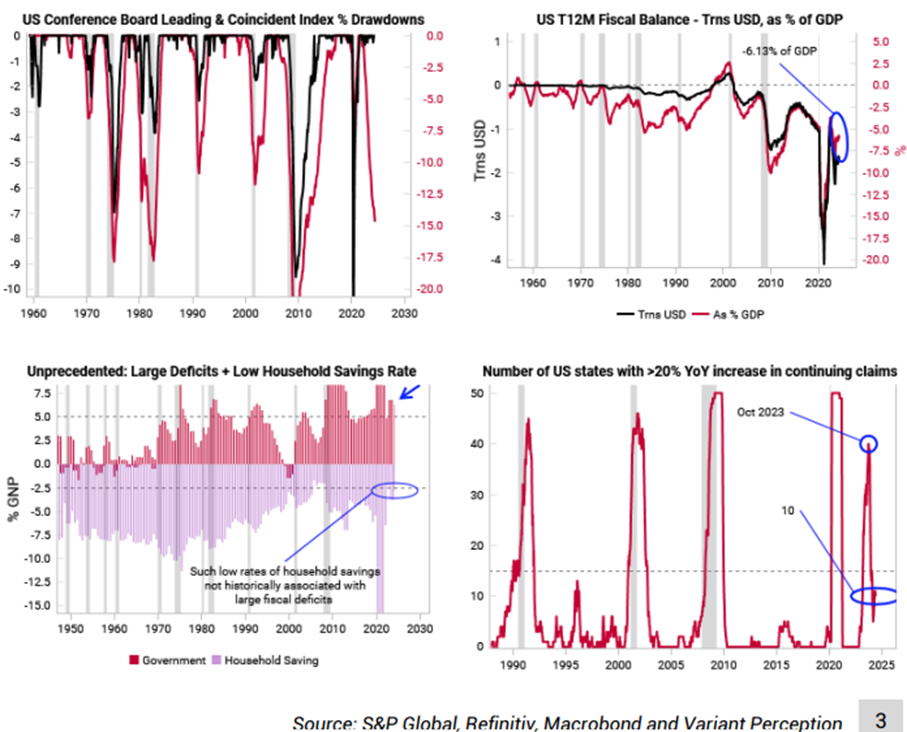

Over the past 18 months, starting from early 2023, there has been a significant debate about whether the economy has experienced a recession or merely delayed it. Despite various leading indicators showing troubling signs, the headline data does not reflect a traditional recession. Labor market data and consumer metrics have remained stable, despite credible analysts suggesting heightened recession risks.

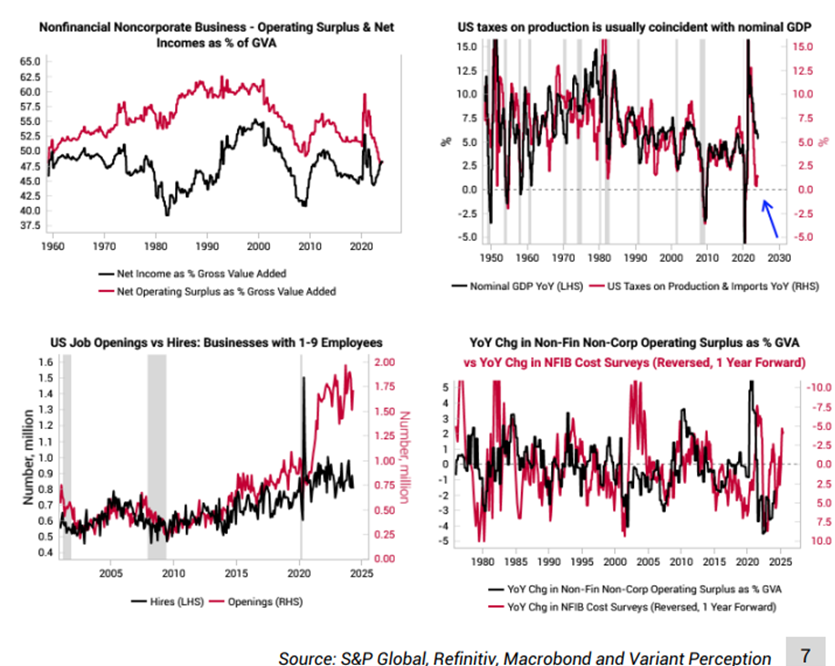

Variant Perception’s analysis reveals that while areas typically hit hard by recessions, such as micro businesses and consumer credit, have shown signs of stress, broader economic indicators have remained resilient. Non-financial, non-corporate operating margins hit all-time lows, and consumer credit card debt showed high delinquency rates. However, these stresses did not lead to a widespread economic downturn, thanks in part to large fiscal deficits and government-driven job creation, which have mitigated negative feedback loops usually seen in recessions.

Inflation Dynamics

The discussion on

[...]