What’s up legends!

Nice little run on BTC early this week. I had some behind the scenes business disasters I had to deal with and couldn’t manage trading and dealing with what I had to so I didn’t personally take the long. And there’s the lesson – recognise where your head is at and if distracted, don’t trade.

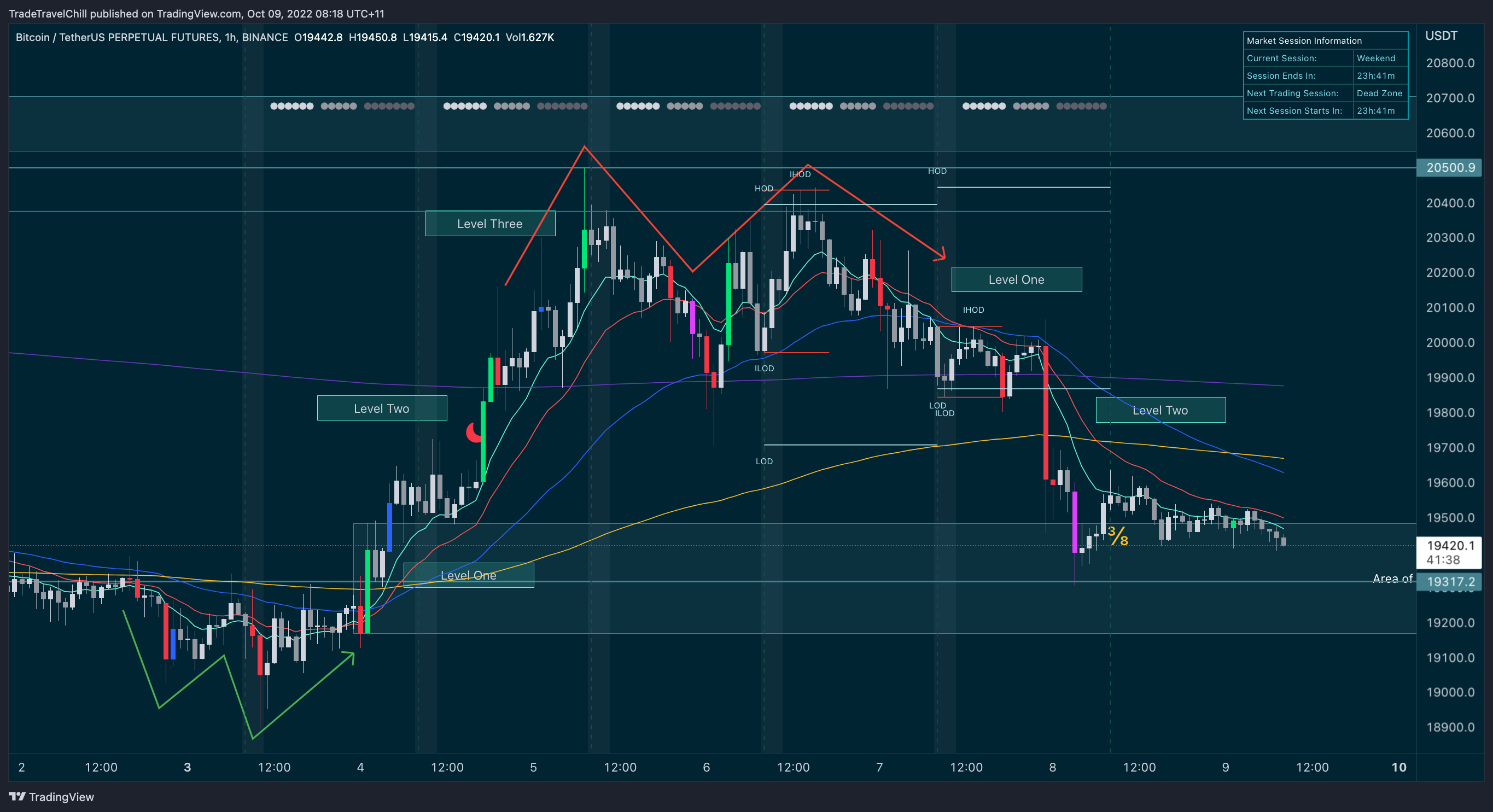

Let’s take a look at the BTC weekly cycle first and see if we managed to have a typical week according to the business model.

BTCUSDT Chart

Looking at the chart above it’s clear to see we very much had a typical week.

TRADE ONE – BTCUSDT

After missing the long at the start of the week, I had to pay close attention and be on the ball for the midweek reversal. The three rises were obvious to me – they took us right to the resistance line of the 1H channel and then we got a SVC. I built positions for this one, with my first entry after that SVC then slowly added positions as we were coming back for the second peak. I was prepared to exit if we broke resistance and this is why I chose to build positions over time, rather than just go all in one entry – because if we did break resistance, I’d be out for much less than 1% loss.

When the second peak came, it came close to the first peak but still failed to get back above it, therefore the trade wasn’t invalidated so I had no reason to exit.

Reasons for entering:

Price at top of 1H channel

Price at HOW and failed to break it

3 Rises previously identified, ending with a SVC

3 hits to a level at level three without breaking it

I have taken partial profit on this one but decided to hold through the weekend as we ended at level two drop. I will reassess at market open or if for some odd reason BTC decides to change direction on a weekend.

Entry type: M formation at level 3

RR: 4.77:1 but trade not yet fully closed

TRADE TWO – ETHUSDT

ETH was a much harder trade this week because price didn’t return to the HOW like BTC did. Regardless, the W and three levels was identified on the 1H TF and that was my trigger to start looking for M’s. I entered this off the 15 min TF but I counted the levels on the one hour as I wanted a midweek reversal swing trade. Below is the 1H chart showing the levels and then the 15min chart showing my entry.

Entry type: M formation

RR: 4.24:1 but trade not yet fully closed

One Hour chart for the count:

Reasons for entering:

Price didn’t break the previous vector candle zone

Previous 3 level rise identified

Midweek reversal due

Waited for 3 hits to the high, the last one was a LH which was my final trigger

Before I continue, allow me to interrupt this broadcast to let you know that coming up this week we have a free masterclass on the OKX exchange. If you are new to trading and find navigating exchanges to be rather difficult, be sure to jump on this session to learn all the little tips and tricks from the Cabin Crew. We run free events in our discord regularly to go over the basics. You can join our discord for free here and once inside, click on the events on the top left-hand side to see everything that’s coming up and which events are free to attend. The next free event is OKX Exchange Tutorial on the 11th of October.

CONCLUSION

Two successful trades this week, no loss. These trades aren’t closed yet so can’t count final account growth. Overall, wasn’t a hugely profitable week for me as I wasn’t actively trading but when you have those really great weeks and you don’t give it all back, those gains make up for the weeks when life gets in the way and you simply can’t trade as actively as you’re used to.

By the way, for members with access to the TBD system, I’ve uploaded a session going into full detail on how to use liquidation data in combination with the business model and it back tests 3 months worth of trades to show you how the TBD system works. If you haven’t seen it yet, definitely check it out. It’s the last video in the Heatmap and Liquidation Data course.

And don’t forget to check the materials tab for a PDF of everything showed in that session.

If you’re not a TTC member but keen to get started, check out our memberships here.

See you next week!

Annii 🙂