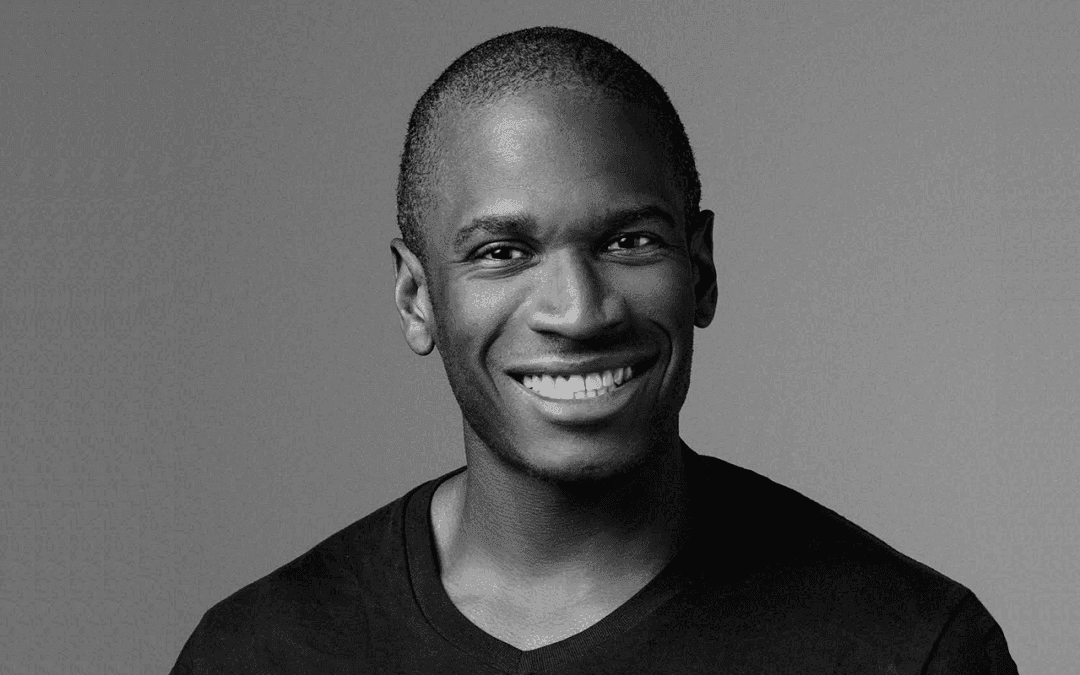

Hello everyone, hope you’re all doing well. When I added Smoking Chicken Fish ($SCF) to the portfolio, some people found it funny and surprising because it’s a pretty unusual coin. I’m not going to say much about the coin itself—I discovered it through Arthur Hayes, who has been actively promoting it.

So today we will know the rise and fall story of Arthur Hayes and how leverage trading started in the Crypto world.

Arthur Hayes, born in Detroit in 1985, grew up in a normal, middle-class family. His parents worked at General Motors, which meant a stable but hardly luxurious life. Arthur’s ambition, however, was anything but ordinary. Sent to a private school in Buffalo, New York, he showed early signs of greatness, excelling in both academics and sports. He joined the tennis team, ran cross-country, and earned scholarships to cover his education. This guy wasn’t going to stay in Buffalo forever.

In 2004, he got into the University of Pennsylvania, and that’s where his ambition really took off. While most students studied hard for Wall Street jobs, Arthur’s mind was already on another level. He didn’t just want a job—he wanted to make a fortune, to become someone

[...]© Copyright 2022 by Trade Travel Chill. All rights reserved.

2 Responses

Great article, cool bit of crypto history, Thx SilverWolf

Arthur Hayes bad boy of crypto Janet Yellen bad gurl of fiat and you have to ask yourself who is winning this one